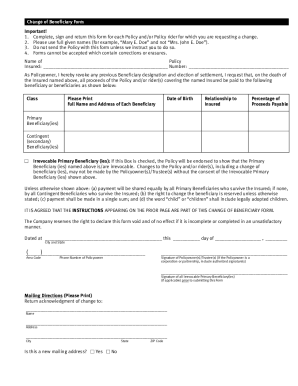

Mutual of Omaha L4609-1 2012-2024 free printable template

Get, Create, Make and Sign

Editing mutual of omaha death claim form online

How to fill out mutual of omaha death

How to fill out mutual of omaha claim:

Who needs mutual of omaha claim:

Video instructions and help with filling out and completing mutual of omaha death claim form

Instructions and Help about mutual of omaha cancer policy claims form

Greetings out there my name is David du Ford owner and operator of buy life insurance for burial calm and chances are you're here today because you're looking for more information on mutual of Omaha's whole life insurance policy what I'm going to attempt to do here in this video is described to you what I commonly see out in the field selling life insurance face to face and give you some inside information as an agent on how mutual of Omaha's whole life insurance policies work so that you can make a better determination if truly it's the right plan for you and then if that's not give you some suggestions on what to do to find something better, so Mitchell Omaha must have you all have heard because of Wild Kingdom of course I'm 31 and have no idea what that was until I was informed by my clients who were in their 50s 60s and 70s, but mutual Omaha is a very reputable company they do a lot of advertising for whole life insurance policies through the mail I haven't seen much in the way of the television ads like a lot of different companies do but primarily what I see from them is their mailing piece where they offer their guaranteed acceptance whole life insurance policy, so I'm going to first start office with the good news, and then I'm gonna also end with the bad news and why you may want to consider another carrier for your burial insurance instead good news is that the prices for mutual Omen are pretty good very competitive relative to even the stuff that I sell not by a long shot I mean just to keep a couple of bucks better maybe but in most cases they're fairly competitive that's the only good news about Mutual of Omaha the bad news about the Mutual of Omaha whole life policies is that they do not cover you for the first two years if you've seen their ads or done any research you're going to see the term guaranteed acceptance there are no questions asked life insurance this is the pivotal word that indicates that because they don't ask questions they're not going to cover you for the first two years that's the catch and that is a problem because if you think through this what happens if something what is you happen to die earlier than expected of course you don't think that, but you know people who have died unexpected we always like the thinking won't happen to us but then sometimes does the key thing is making sure that you're protected so that your family is protected, and you're protected optimally from as much coverage as you can in the beginning and with the best plan up front to begin with that's pivotal and the thing is if Mutual of Omaha the people that apply for it and eight out of ten times can get something that will not only give them something pretty close to price but also will fully cover them from the first day and I can't express this enough have multiple examples where I've insured people in fact I had two this year died that had their insurance policies less than two years luckily I got them insurance one had had a stroke...

Fill mutual of omaha cancer insurance claim forms : Try Risk Free

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your mutual of omaha death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.